According to IBISWorld latest report on Supermarkets & Grocery Stores, there were a total of 63,328 grocery businesses in the US in 2022 (a slight decline of -1.2% compared to the previous year). Out of all states, New York, California and Florida accounted for the largest chunk of supermarkets and grocery stores, and the largest business overall being The Kroger Co. (which operates a number of brands that it has acquired).

But which store is the most beloved? Selecting the favourite supermarket chain may be a matter of personal taste (and other factors such as the proximity of stores, variety & product quality, prices or loyalty program options). Interestingly, 24/7 Tempo recently conducted a study researching the most popular grocery store chains in every US state. The ranking is based on a combination of Yelp reviews and Google Trends data.

Since we know that customer loyalty is paramount in the grocery sector and shoppers often admit to choosing their favourite chain based on the rewards program (which is even more true in the post-covid, super-high-inflation era), we decided to compare rewards programs of most loved grocery retailers in each US state to see what approach they chose for their businesses.

US Northeast

[table id=1 /]

It's obvious that when it comes to loyalty at grocery stores, the one-size-fits-all (customers) approach will no longer cut it. Shoppers require individual treatment, offers, and communication based on their personal preferences.

With data being the lifeblood of any modern rewards programs, it is no wonder that most popular retailers rely on mobile applications as the channel to collect data and present personalised offers. According to the Loyalty Report Index conducted by Incisiv, more than 70% of shoppers prefer participation in a loyalty program that provides access to loyalty cards and rewards via the branded mobile application.

This trend is clearly visible at all favourite chains in the Northeast, with only exceptions being Trader Joe's and Aldi. Trader Joe's states that people deserve good offers every day and their private-label items are already so cheap that providing any sales, coupons, or loyalty program whatsoever is not an option. The same applies to Aldi, the retailer famous for its low prices. Though they run Weekly Specials, there's no official loyalty program in use. Both are examples the rare breed of strong brands where not having loyalty is a legitimate part of their "every day low price" brand proposition.

Side note: Interestingly, LIDL in Europe switched from this narrative into providing a rich, app-based loyalty club experience and became one of the leaders of modern loyalty use in grocery retail, so we would not be surprised if either Aldi or Trader Joe's change their minds on the subject going forward.

Courtesy of Hannaford, Safeway, Stop&Shop, Market Basket

US South

[table id=2 /]

The grocery store loyalty landscape seems to be more diverse in the South. While mobile apps stay predominant, there are still a few retailers (on top of the already mentioned Aldi and Trader Joe's) that rely or old-style card-based programs or digital coupons accessible via website.

There's, however, another interesting trend - premium (paid) loyalty programs. Actually, according to Clarus Commerce 2022 Premium Loyalty report, 78% of consumers stated that they would be willing to pay for a premium loyalty program in return for immediate benefits. Quite understandably, groceries and gas discounts are ranking high among the most attractive benefits, primarily driven by the worrisome inflation of the past few months.

Kroger was one of the first retailers to test this approach (most likely as a response to super popular Walmart+ and Amazon's Prime), introducing Boost loyalty program at the end of 2021. While consumers could still enjoy some free perks at its locations, they had an option to enrol in a two-tier loyalty program to enjoy instant benefits such as extra savings on specialty brands, free next-day delivery or even free delivery in as little as 2 hours. All of this for $59 (tier 1) / $99 (tier 2) per year. In addition, the company initially offered a one-time welcome kit worth over $100 to make up for the first year's cost.

Courtesy of Kroger, Publix, Food Lion

US West

[table id=3 /]

In the list of the Western states' favorites, Albertson Companies dominate the market. All of its sub-brands are equipped with for U® loyalty scheme, and a mobile application as the primary communication channel. The app lets members view and use personalised coupons and offers, redeem rewards (free groceries, gas, or even cash discounts), create shopping lists, use online ordering for delivery or click&collect.

Another half of the list consists of Kroger-owned businesses. It's represented by King Soopers, Smith's, and Fred Meyer, which all participate in its Boost loyalty program. A paid two-tier membership program was introduced at the end of 2021 and is expected to gradually expand nationwide.

Courtesy of Kroger

US Midwest

[table id=4 /]

Looking at the Midwest, apart from Albertson Companies (Jewel-Osco) and Kroger, there are 3 more brands with different approach to loyalty.

Hy-Vee is one of the brands that debuted paid membership loyalty program ($99 annually or $12.95 monthly) back in 2020. The benefits include access to monthly offers and coupons, free grocery delivery, or free two-hour express pickup. Moreover, Hy-Vee offers a personal concierge "Red Line" for its members, in which they can use a dedicated customer assistance line to get help and personal shopping service. The program offers additional benefits on top of their Fuel Saver + Perks program, thus providing additional fuel savings as well.

Meijer, a retailer popular in Michigan and Wisconsin, launched the very first version of its mPerks (a free digital coupon program in which shoppers earned discounts without having to cut, print or present a coupon upon checkout) already back in 2010. Since then, the program was enriched with many new features to keep up with competition. Introducing a mobile app was a logical step to allow customers track their progress towards rewards, use shop&scan in stores, or keep digital receipts in one place. Thus like other retailers, the current incarnation of mPerks also uses mobile app and personalised offers at the core of their loyalty proposition.

Hornbacher's with its 9 North Dakota locations is the smallest retailer to make it to the list. Even that did not stop the company from launching a mobile app as the main communication channel. What differentiates it from other companies is that a customer can track progress towards one of 5 categories of rewards: Rotisserie Chicken, Deli Sandwich, Deli Hot Meal, Soup & Cake. To get a free reward from a particular category, a customer needs to purchase six items (a typical stamp card system gone digital). Online shopping, weekly ads, shopping lists, recipes, etc. just add to the app's value.

Note: The loyalty mechanics in use here is simple to manage and easy to communicate - something we love to see for medium-sized retailers!

Courtesy of Hy-Vee, Meijer, Hornbacher's

Summary

Unless the value proposition screams "every day low price", you will find some kind of loyalty proposition at almost all grocery retailers. However, many retailers with legacy systems and older technology might find themselves struggling to keep up with their competition. Digitalisation simply becomes a symbol of new data-rich era and is already considered a must for any modern rewards system.

Given consumers' dependence on new technology, even the simplest loyalty schemes nowadays require data collection for personalisation of content and offers as well as channel diversification to stay in touch with as many of their customers as possible. That's why mobile applications are becoming so important for any loyalty program strategy - they simply provide businesses with the most personal engagement and communication options with the customer.

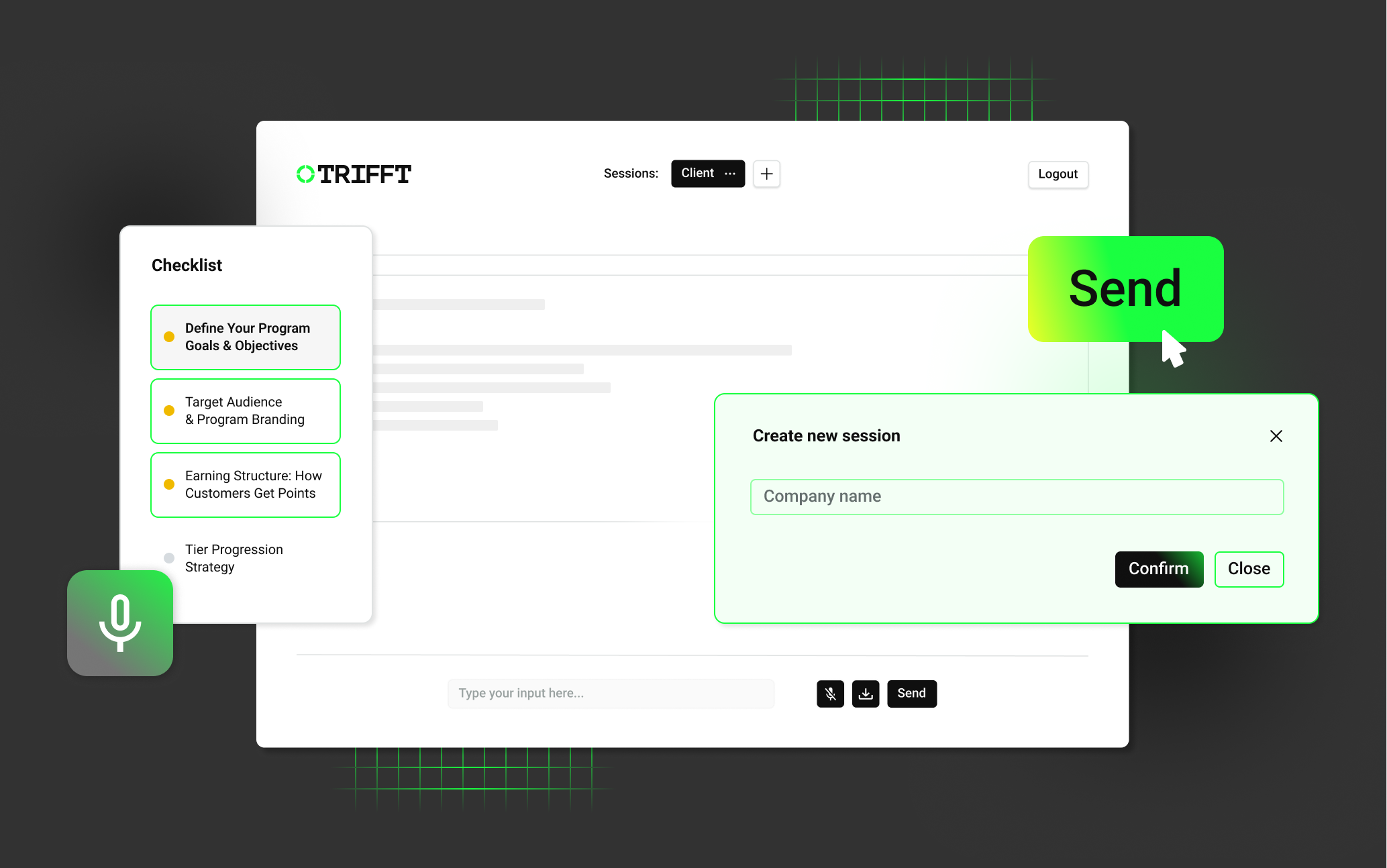

To build a truly omnichannel loyalty program may seem frightening at first. Fortunately, the times when everything had to be done in-house or with the costly help of agencies are gone and you can rely on companies such as TRIFFT Loyalty Cloud to do this job for you.